Trending Now

- Alliance talks between AIADMK and BJP are ongoing. An announcement will be made at the right time – Union Home Minister Amit Shah.

- Vijay spoke about TVK vs. AIADMK only to motivate party workers – AIADMK General Secretary Edappadi K. Palaniswami.

- South Indian audiences are not interested in Hindi films, which is why they don’t succeed – Salman Khan.

- KL Rahul joins Delhi Capitals; the team will face Hyderabad tomorrow.

Business

The Importance of Future Planning: Small Steps, Big Impact

![]() April 25, 2025

April 25, 2025

Everyone wants a secure future, but not everyone takes the right steps to achieve it. Future planning is not just about saving money but about making smart financial decisions. Small, consistent actions can lead to financial stability and peace of mind.

From budgeting to investing, every step matters.

Let’s explore how careful planning today can create a stress-free future.

Why is Future Planning Essential for Financial Security?

Financial security is not about how much you earn but how well you manage your finances. Without a proper plan, unexpected expenses can disrupt your financial health. Future planning helps you:

Build a safety net for emergencies

Secure funds for life goals like education and retirement

Reduce financial stress by ensuring stable income sources

A well-planned financial future ensures you can handle uncertainties while achieving your dreams.

How Can Small, Consistent Actions Lead to Significant Long-term Benefits?

Future planning does not require big changes overnight. Consistent small steps can make a huge difference. Here’s how:

Saving a small monthly amount can help you create a substantial emergency fund.

Investing early helps you take advantage of compounding.

Buying a life insurance policy secures your family’s future.

Tracking expenses ensures better financial control.

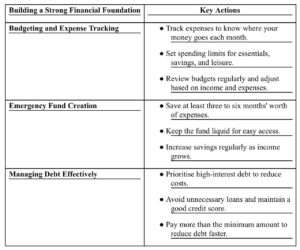

Why You Should Consider Building a Strong Financial Foundation?

The first step towards future security is a strong financial foundation.

What are the Investment and Wealth Growth Strategies You Should Consider?

Investing is essential for creating long-term financial growth.

Starting with Small Investments

Even small investments can grow over time. You can start with:

Recurring deposits for low-risk savings

Mutual funds for long-term wealth creation

Stocks for higher returns with calculated risk

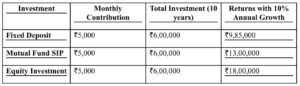

Power of Compounding and Long-term Gains

Compounding helps you earn interest on your original investment as well as on the returns you’ve already accumulated. Consider this:

Diversification for Risk Management

Diversifying investments helps manage risk effectively. Strategies include:

Invest in a combination of bonds, stocks, and real estate

Choosing different sectors to avoid market fluctuations

Regularly reviewing and adjusting investments based on performance

How Can You Ensure Financial Security with Insurance?

Insurance acts as a financial shield against life’s uncertainties.

Importance of Life Insurance for Long-term Stability

A life insurance policy provides financial security for the future of your family. Benefits include:

Providing financial support in case of emergencies

Covering education and living expenses for family members

Offering tax benefits under Indian tax laws

How a Guaranteed Return Investment Plan Can Provide Financial Certainty

A guaranteed return investment plan helps create a secure financial future. Benefits include:

Fixed returns regardless of market conditions

Regular payouts for planned expenses

Low-risk investment with assured growth

Preparing & Planning for Bigger Life Goals

Financial planning should include long-term goals for stability and growth.

Homeownership and Real Estate Planning

Purchasing a home is an important financial commitment. Plan by:

Saving for a down payment early

Considering loan eligibility before applying

Investing in a property that aligns with future goals

Child’s Education Fund

Higher education costs are rising. Start saving early by:

Investing in a child education plan

Using mutual funds or fixed deposits for better returns

Choosing government schemes for tax benefits

Retirement Planning and Pension Funds

Retirement planning ensures a comfortable life post-employment. Consider:

Investing in pension schemes for regular income

Building a diversified retirement portfolio

Calculating post-retirement expenses to plan effectively

Financial planning is not about making drastic changes. Small, consistent steps can create a strong financial future. From budgeting to investing, every decision plays a role in long-term stability. A life insurance policy secures your family, while a guaranteed return investment plan offers financial certainty. Start today, stay committed, and enjoy financial peace of mind.